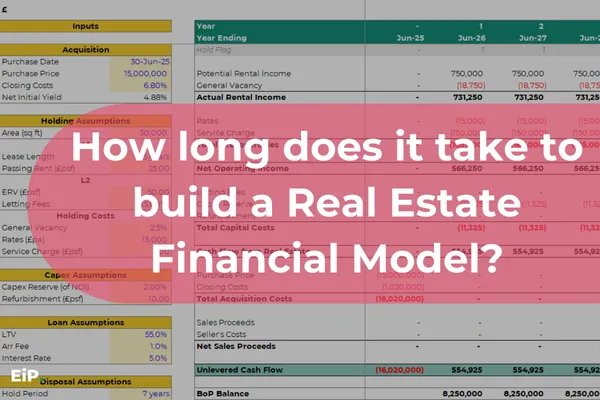

How long does it take to build a Real Estate Financial Model – and how to do it faster

How long does it take to build a Real Estate Financial Model – and how to do it faster

Everyone wants the answer to one simple question: how long does it take to build a financial model?

You might be sitting there thinking, "It always takes longer than I expect, and 'it depends' isn't helpful when deadlines are looming!" And if that is you, YES! I agree, the typical answer can feel frustratingly vague, AND it's crucial to understand the underlying factors so you can take control and cut down that time significantly.

The problem? The answer is “it depends” – and that’s not very helpful when you’ve got an investment committee breathing down your neck, a JV partner asking for numbers, or a promotion interview where you’re expected to run scenarios live.

So let’s talk specifics: how long it really takes, why it often takes longer than you expect, and most importantly – how to cut that time without cutting corners.

The extremes: from 8 hours to 58 hours

To make this real, let me share the extremes from my own career.

Fastest build: I once delivered a full £30m development model in just 8 hours. It had three JV partners, multiple funding lines, and all the standard bells and whistles. The speed wasn’t about luck – it was about knowing the structure, having the right frameworks, and not starting from a blank sheet of Excel.

Slowest build: My first ever client project? 58 painful hours. Most people don't realise this kind of struggle happens because they're making the most common mistake without even knowing why: a lack of clear scope, no foundational frameworks, and a brief that boiled down to: “deliver a model based on our meeting.” This is a guaranteed way to spend weeks banging your head against the wall, losing valuable time and money.

👉 Lesson: time isn’t just about the technical build – it’s about clarity, process, and structure.

The common misconception

People assume models take forever because they’re “complex.”

But complexity is only part of the problem.

The real time killers are:

Lack of scope: unclear briefs mean endless revisions.

Poor assumptions: garbage in = hours of rework.

Reinventing the wheel: starting from scratch every time.

Stakeholder delays: waiting on JV partners, funders, or clients for inputs/reviews.

That’s why I always advise clients to budget 4–12 weeks for a full programme. Not because the Excel itself takes that long – but because reviews, audits, and client-side delays will.

How long it really takes (by type of model)

Here’s a rough guide to typical build times (ignoring client-side delays):

Simple tenancy cash flow / asset-level DCF: 1–2 days.

Investment appraisal with debt: 3–5 days.

Full development appraisal: 1–2 weeks of build time, plus client reviews.

Complex JV / fund model: 4–12 weeks end-to-end (because of audits, sign-offs, and bespoke structures).

And here’s an important nuance: the Excel build is only a fraction of the total timeline. The process is what drags out projects.

What about modelling tests?

If you’ve ever sat a modelling test for an analyst role, you’ll know speed is everything.

In my course How to Pass a Financial Modelling Test, we train students to build a working model in under 90 minutes. That’s enough to demonstrate competence and commercial thinking under pressure – but let’s be clear, it’s not a model you’d ever want to use for an actual deal.

Why? Because deal-ready models need audit trails, sensitivity analysis, proper debt structuring, layered assumptions, and a robustness you simply don’t have time for in an interview setting.

👉 Key point: test models show speed; deal models show rigour. Both matter, but they’re not the same thing.

Why speed matters in real estate

Speed isn’t just about efficiency – it’s about money, opportunity, and credibility.

Deal deadlines: If you miss them, you miss the deal.

Scenario testing: The faster you can flex assumptions, the more confident you are in your investment decisions.

Career impact: Analysts who can turn models quickly (and accurately) get noticed – and promoted.

The cost of not being fast isn't just inconvenience; it's lost deals, missed promotions, and a constant feeling of playing catch-up. How much is that costing your career right now?

How to do it faster without cutting corners

You can’t eliminate reviews, audits, or client delays. But you can eliminate wasted hours rebuilding the same logic from scratch.

Here’s what makes the biggest difference:

1. Start with a proven structure

Don’t reinvent the wheel. Have a modular framework you can adapt to each project.

2. Clarify the scope upfront

Know exactly what the model needs to achieve before you open Excel.

3. Use plug & play templates

Whether it’s a DCF, a development appraisal, or a JV waterfall – a tested template saves you hours of build time.

4. Stress-test assumptions early

Catch the “garbage in” problem before it forces a rebuild.

The EiP Model Library: weeks of time, saved

That’s exactly why I created the EiP Model Library.

Plug & play templates – pre-built, professional-grade models you can adapt in hours, not weeks.

Proven structures – tested across billions in real estate assets, so you’re not second-guessing formulas.

Commercial focus – everything designed to work in the real world, not just look good on a test.

With the Model Library, you go from staring at a blank workbook to presenting a polished, investor-ready model in a fraction of the time.

👉 Ready to transform your modelling process and reclaim countless hours? Join the waitlist for the EiP Model Library and cut weeks off your modelling time.

Final thoughts

So, how long does it take to build a real estate financial model?

Anywhere from 8 hours to 12 weeks – depending on scope, process, and client-side delays.

A modelling test? Less than 90 minutes – but that won’t cut it for actual deals.

The truth is, the Excel build isn’t what slows you down. It’s the process, the scope, and the lack of structure.

If you want to stop wasting hours reinventing the wheel – and start running deals faster, smarter, and with confidence – the EiP Model Library is the simplest way forward.

👉 Imagine being the analyst who consistently delivers accurate models ahead of schedule, impressing your team and leadership. That future is within reach. Get on the waitlist today.